Aerospace Outlook

The outlook for the commercial aircraft industry is extremely positive, supported by global growth in passenger travel, strong fleet growth in developing countries and demand for newer, fuel efficient aircraft. Boeing and Airbus have announced significant production increases and approximately 9,000 commercial aircraft are in backlogs. Suppliers will be challenged to keep pace. Commercial aftermarket support activities, including MRO’s and FBO’s are also expected to do well as the number of aircraft and flying hours increase. Both strategic and private equity firms are very interested in M&A opportunities in the commercial aerospace industry, particularly for supply chain consolidation opportunities to take advantage of the expected 7- 8 year, long-cycle demand. There is also a trend among manufacturers to reduce their number of vendors to better coordinate supply logistics and reduce schedule risks, which is also bolstering consolidation interest.

Defense & Government Services Outlook

Defense and government service contractors face a much more challenging environment than their aerospace counterparts. Sequestration spending cuts totaling $85 billion for the current fiscal year were triggered on March 1st. Of this amount, $42.7 billion applies to defense. This will further cut already tighter DoD budgets being proposed by Congress and the President. Companies in this sector are positioning for revenue and profitability challenges by:

- focusing on core competencies;

- cutting costs;

- emphasizing unique value-added products and services that deliver enhanced performance and efficiencies;

- attempting to increase non-US military sales; and

- exploring commercial market applications for technologies originally developed for defense projects. Cyber-security is a particularly hot area of interest.

Nearly all defense and government service companies are proactively considering acquisitions and divestitures as a means to accomplish these objectives. We expect defense and government services M&A activity to increase later in 2013 and into 2014 as managers become more accustomed to the new environment and certain private companies recognize the need for increased breadth and financial support in the new environment.

Incumbent contractors that want to survive and thrive during the next decade are likely to divest non-core activities and seek to build/acquire proprietary capabilities that differentiate them from their competitors. This has been evident in Northrop Grumman’s (NYSE:NOC) spin-out of Huntington Ingalls (NYSE:HII) and L-3’s (NYSE:LLL) spin-out of Engility (NYSE:EGL); as well as ITT’s (NYSE:ITT) split and SAIC’s (NYSE:SAI) planned split into separate defense and commercial units – Exelis (NYSE:XLS) and Leidos. Companies with proprietary technology, products and services that are aligned with the DoD’s strategic direction will become increasingly attractive.

Conversations with certain defense contractors indicate some agency program managers are already holding back spending, even on approved programs, until their own agency budget situations become clearer. AeroVironment (Nasdaq:AVAV), the largest producer of small drones for the US military may be an early indicator of what could be a pervasive “spending slowdown” phenomena taking place. On March 5th AVAV reported that its 3rd quarter (January 31st) revenue dropped 35% amid a slowdown in military orders, which caused its stock to fall nearly 10% the following day. The DoD has approved funding for AVAV’s Raven drones, but the contract is simply completing much more slowly than anticipated (admittedly perhaps partially influenced by the debate taking place in Congress about the appropriate future use of drones). Nonetheless, it will be interesting to see how widely AVAV’s experience is being shared by other defense/government contractors, most of whom will report March quarter results during May – and also whether any such seasonal “spending slowdowns” catch up later during the June and September quarters when agencies will presumably want to spend their budget allocations by fiscal year-end. Such a spending slowdown phenomena should be more pronounced for smaller companies with less diversified, shorter-cycle programs than would be the case for larger defense contractors with more diversified programs and longer-term contracts. In any case, uncertainty, worry and risk aversion are all currently high in the sector.

M&A Notes

Westbury was the investment bank advisor for two transactions that closed during the fourth quarter of 2012. Westbury advised Applied Physical Sciences on its sale to General Dynamics' Electric Boat division (NYSE:GD) and also advised RNB Technologies on its sale to Oasis Systems. Press releases from these two transactions are included at the end of this report. Terms were not disclosed for these transactions. Press releases for these transactions may be found at the end of this article.

During the first quarter of 2013 we counted 24 closed acquisitions in the aerospace, defense and government services sectors. This compares to 38 in 1Q 2012 and 46 in 4Q 2012.

The largest M&A transaction in 1Q 2013 was commercial satellite imagery provider DigitalGlobe’s (NYSE:DGI) $900 million total enterprise value (TEV) purchase of former competitor GeoEye in January. This transaction was originally announced last July, but needed federal approvals, including anti-trust approval. Westbury banker Ron Hodge has had an interesting perspective of the evolution of this industry and the company participants. While working at a different institution during the mid-1990’s, Ron invested in the first institutional rounds for both Earth Watch, the predecessor company supported by Ball Aerospace (a subsidiary of BallCorp. (NYSE:BLL) that was later renamed DigitalGlobe; and OrbImage, the predecessor company supported by Orbital Sciences (NYSE:ORB), which ultimately became GeoEye. Ron was also a financial advisor to Space Imaging in 2004-2005 when it was evaluating financing options, prior to ultimately deciding to sell to OrbImage for $58 million in January 2006, at which time the combined companies were renamed GeoEye.

For trivia buffs, during the industry’s formative years, DigitalGlobe’s predecessor company Earth Watch was a distant third place in securing customers and the prevailing wisdom was that the industry could only support two players. Space Imaging (controlled at the time by Lockheed Martin (NYSE:LMT) and Raytheon (NYSE:RTN)) and OrbImage appeared to be the two industry winners as a result of securing contracts to provide imagery to the National Imaging & Mapping Agency (NIMA), the predecessor to the National Geospatial Intelligence Agency (NGA). The NGA has always been the industry’s largest customer and is crucial for these companies’ business models to work. The main reason Earth Watch managed to survive during the years following its formation, as it lacked a meaningful imagery customer, was due to a failed satellite launch - for which it collected insurance proceeds that enabled it to remain solvent. It also benefited several years later from Space Imaging’s inability to organize funding (at a time when it was the largest industry player) to develop next generation satellites when NGA was seeking bids for its Next View program. This ultimately led to Space Imaging’s sale to OrbImage and the combined companies renaming themselves GeoEye . It’s kind of ironic that from such an inauspicious beginning DGI winds up becoming the ultimate industry survivor, which currently sports a TEV of nearly $2.4 billion. An observation about this transaction that may extrapolate to the present tighter government spending environment: while the NGA and other agencies prefer to have multiple vendors, Pentagon budget cutbacks may undercut the economic viability of such arrangements. Thus, consolidations or joint ventures, such as described in the space imagery market, where the agency effectively determines which company becomes the US’s “national provider” (and ultimate survivor) may become more common.

Other notable first quarter M&A transactions:

On 3/17/2013 Farmington, CT based Edac Technologies (NASDAQ:EDAC) accepted a $17.75 per share offer from private equity fund Greenbriar Equity Group. MidOcean Partners subsequently made an unsolicited $18.25 per share offer, which it later withdrew. EDAC is currently trading around $18.50, which implies a TEV of $135 million and TEV/EBITDA of 9.5x and TEV/Revenue of 1.3x.

United Technologies (NYSE:UTX) continued its active divestiture program following its $18.4 billion of Goodrich acquisition last year. On 3/27/13 it closed the sale of Goodrich Electrical Power Systems, a manufacturer of on-board aerospace electrical power systems to Safran (NYSE Euronext Paris: SAF) for approximately $400 million, implying a TEV/Revenue multiple of 1.9x. On 3/18/13 UTX also completed the sale of West Hartford, CT based Goodrich Pump & Engine Control Systems, which has revenue of approximately $195mm, to Triumph Group (TGI) for an undisclosed price.

On 3/18/13 British company MB Aerospace announced that Arlington Capital Partners completed a secondary MBO in which Arlington will take a majority stake in the business alongside its management team. Arlington will also provide significant funding for a planned series of acquisitions. A partner at Arlington commented: “Going forward, MB Aerospace is well positioned to lead a consolidation effort in the highly fragmented mature and legacy aero-engine market. The Company’s best-in-class engineering expertise, strong history of past performance and unique market focus enable MB Aerospace to partner with OEM’s to address overall under-performance issues in their supply chains.”

In a similar transaction, on 2/20/13 Dynamic Precision Group, a portfolio company of Carlyle Group, purchased former American Capital (NASDAQ:ACAS) portfolio company Paradigm Precision Holdings for $129 million. Paradigm Precision Holdings makes complex machined components for the aerospace, power generation and marine markets and had been an aerospace supply chain roll-up platform company for a strategy ACAS initiated in 2007. ACAS’s initial investment was $108 million and ACAS reported that it earned an 11% compounded return on its investment in senior debt, subordinated debt and equity securities during its holding period.

ITT Exelis (NYSE:XLS) completed the acquisition of Australian company C4i Pty from Longreach Group (ASX:LRG) on 1/31/13 for US$ 16.8 million, which is believed to be about a TEV/Revenue multiple of 1.6x. The company makes advanced communication software to support mission critical communications applications including air traffic management, defense, public safety and homeland security.

TriMas (NASDAQ:TRS) announced on 1/29/13 its acquisition of Martinic Engineering for approximately $19 million, implying a TEV/Revenue multiple of 1.4x. Martinec manufactures highly engineered, precision machined aerospace parts as well as electrical, hydraulic and pneumatic systems.

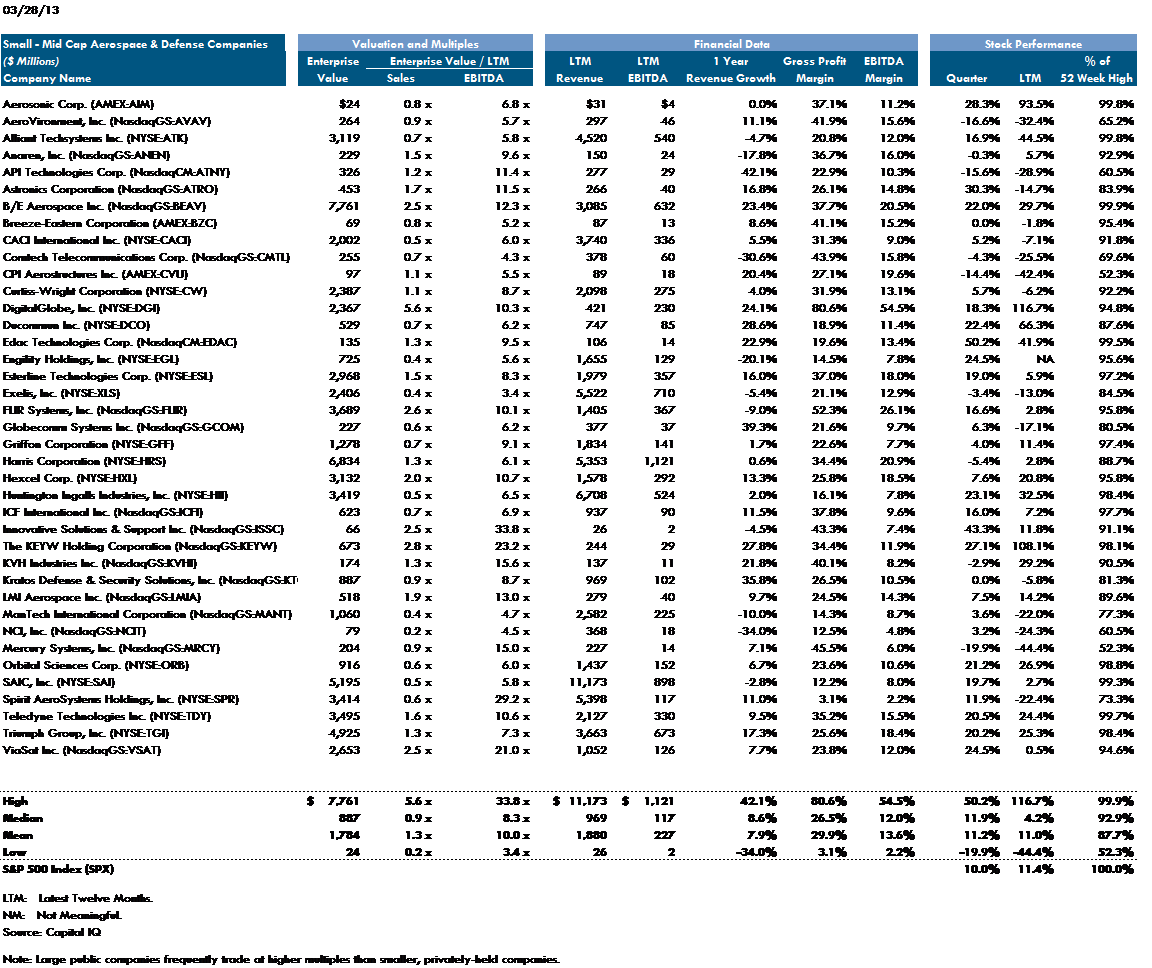

Public Comparables

Consistent with the overall market hitting new highs at the end of the quarter, most Aerospace & Defense and Government Services companies ended the quarter trading near their 52 week highs. As shown below, on average large cap stocks slightly underperformed the S&P 500 during the first quarter by about 40 basis points, but outperformed during the trailing 12 months by 240 basis points.

In the second chart, one can see that individual small-mid capitalization stock performance varied widely relative to the S&P 500. On average, however, this subset of stocks outperformed the S&P 500 by 120 basis points during the first quarter, but trailed the S&P 500 by 40 basis points during the trailing 12 months.

TEV/EBITDA (TTM) multiples tended to hover in the 7-8x range, but a number of companies including NOC, CMTL, XLS, MANT and NCI are trading a multiples of less than 5x EBITDA, mostly due to their exposure to government markets and expectations for lower trending EBITDA. Generally speaking, pure-play contractors are trading at the lowest EBITDA multiples, service-oriented contractors are trading at slightly higher multiples. Companies with heavier exposure to commercial markets and cyber security are generally trading at the highest multiples.

Research Team

- Ron Hodge, Group Head

- Alan Carter

- Patrick Huddie

- Maris Licis

December 21, 2012: Westbury Group Serves as Exclusive Financial Advisor to Applied Physical Sciences Corp. on its Sale to General Dynamics

Dec. 21, 2012 -- Westbury Group acted as the exclusive financial advisor to Applied Physical Sciences Corp. (APS) on its sale to General Dynamics Corporation (NYSE: GD) in an all-cash transaction that closed on December 21, 2012. Westbury Group, which has been an advisor to APS since 2009, worked closely with the company’s Board throughout the sale process. This included providing strategic advice, managing the preparation of information materials, identifying potential buyers, marketing the transaction, soliciting and evaluating offers, negotiating terms, coordinating due diligence, and assisting the company and its legal advisor, Edwards Wildman Palmer LLP, in negotiating the purchase agreement and related documents.

The press release issued by General Dynamics reads as follows:

“FALLS CHURCH, Va., Dec. 21, 2012 /PRNewswire/ -- General Dynamics (NYSE: GD) today acquired Applied Physical Sciences Corp. of Groton, Conn., in a cash transaction for an undisclosed price. Applied Physical Sciences is a leading provider of applied research and development services, and will complement the engineering programs of General Dynamics Electric Boat, a wholly owned subsidiary of General Dynamics. Applied Physical Sciences offers research, development, engineering and prototyping services to government and commercial customers in the areas of acoustics, signal processing, marine hydrodynamics and electromagnetics. It is an industry leader in the fields of directional underwater transducers, maritime and ISR (intelligence, surveillance and reconnaissance) sensing and communication systems, and special purpose underwater devices for government laboratories, universities and industry. The company has 95 employees. Kevin J. Poitras , president of General Dynamics Electric Boat, said, “This acquisition enhances Electric Boat's ability to respond to emerging submarine requirements using the engineering knowledge and rapid- prototyping capabilities of Applied Physical Sciences, and gives the talented professionals at Applied Physical Sciences additional insight into the needs of the U.S. submarine fleet.” “The greatest beneficiary of this acquisition will be the U.S. Navy, which will get more capable submarines to use in maintaining its global undersea dominance,” Poitras said. Charles N. Corrado , president of Applied Physical Sciences, said, “Our new relationship with General Dynamics and Electric Boat will greatly enhance our ability to transition systems to the submarine fleet. We are excited about the new opportunities this will provide to have a real impact on U.S. Navy capabilities, and to grow the company.”

Applied Physical Sciences' headquarters and manufacturing facility are located in Groton. It also has offices in Lexington, Mass.; Arlington and Suffolk, Va.; and San Diego.

General Dynamics Electric Boat designs, constructs and provides life cycle support for U.S. Navy nuclear submarines.

More information about General Dynamics is available online at www.gd.com.”

October 2, 2012: Westbury advises RNB Technologies, Inc. in its sale to Oasis Systems.

RNB Technologies, Inc. is a Virginia-based defense contractor that provides services in systems engineering, test and evaluation and information technology.

Oasis Systems, based in Massachusetts, provides Information Technology Applications to the Department of Defense. Oasis considers that this acquisition will allow it to provide its services to more agencies and in additional regions while becoming more competitive through reduced unit overhead costs.

Westbury Group LLC provides financial and strategic advisory services for small to middle-market firms. Typical transactions range in size from $10 million to $150 million and may include mergers and acquisitions, raising debt and equity capital as well as providing strategic counsel.

Notice & Disclaimer

These materials were prepared by Westbury Group, LLC (“Westbury”), a broker-dealer registered with the Securities and Exchange Commission (“SEC” at www.sec.gov) and a member of the Financial Industry Regulatory (“FINRA” at www.finra.org) and the Securities Investor Protection Corporation (“SIPC” at www.sipc.org).

Westbury may act as investment banker to specific companies in the industry sectors described in this report by providing merger, acquisition, divestiture, private placement and other advisory services.

Westbury gathers its data from sources it considers reliable. However, it does not guarantee the accuracy or completeness of the information provided in this report. The material provided herein reflects information known to the authors at the time this report was written and such information is subject to change. Westbury makes no representations or warranties, expressed or implied, regarding the accuracy or completeness of this report.

Information, opinions and any estimates contained in this report reflect Westbury’s judgment as of the date written and are subject to change without notice. Westbury undertakes no obligation to notify any recipient of this report of any such change.

This report does not constitute advice or a recommendation, offer or solicitation with respect to the securities of any company discussed herein, is not intended to provide information upon which to base an investment decision, and should not be construed as such. Officers, directors, partners and employees of Westbury and its affiliates may have positions in the securities of the companies discussed, if any.

This report is not directed to, or intended for distribution to, any person in any jurisdiction where such distribution would be contrary to law or regulation.

Any public companies presented in this report are companies commonly used for industry information to show performance within a sector. They do not include all public companies that could be characterized within the identified sector and do not constitute recommendations for a particular security or sector. The charts, graphs and tables used in this report have been compiled by Westbury solely for the purposed of illustration.